Spot Loan

Fast and Flexible Financing

Meet your urgent financing needs with Spot Loan, offered exclusively to Figopara customers by İş Bankası.

What is Spot Loan?

Spot Loan is a fixed-interest-rate, short-term loan designed to meet the urgent cash needs of commercial businesses. Thanks to its fast approval process and flexible maturity options, it supports your financial planning safely.

Dijital Başvuru

Spot Kredi’ye başvurular tamamen online yapılır, şubeye gitmenize gerek yoktur.

Evraksız İşlemler

Islak imza, fiziksel evrak gerektirmez; tüm işlemler oturduğunuz yerden gerçekleştirilir.

Anında Erişim

Başvurunuz onaylandığında, kredi tutarınız doğrudan hesabınıza yatırılır.

Online Application

You can apply for a Spot Loan online; there is no need to go to the branch.

Paperless Transactions

No wet signatures or physical documents are required; you can manage all processes wherever you want.

Instant Access

Once your application is approved, your loan amount will be deposited directly into your account.

Advantages of Spot Loan

Financing Without Invoice Collateral

Fast Approval Process

Fixed Interest Rate

Flexible Maturity Options

Payment at the End of Maturity

Figopara Commercial Spot Loan

With Spot Loan, offered exclusively to Figopara customers by İş Bankası, we quickly solve your business's financing needs. Designed for a completely digital experience at every step, from the loan application process to approval, this product will strengthen your business's future by organizing your short-term cash flow.

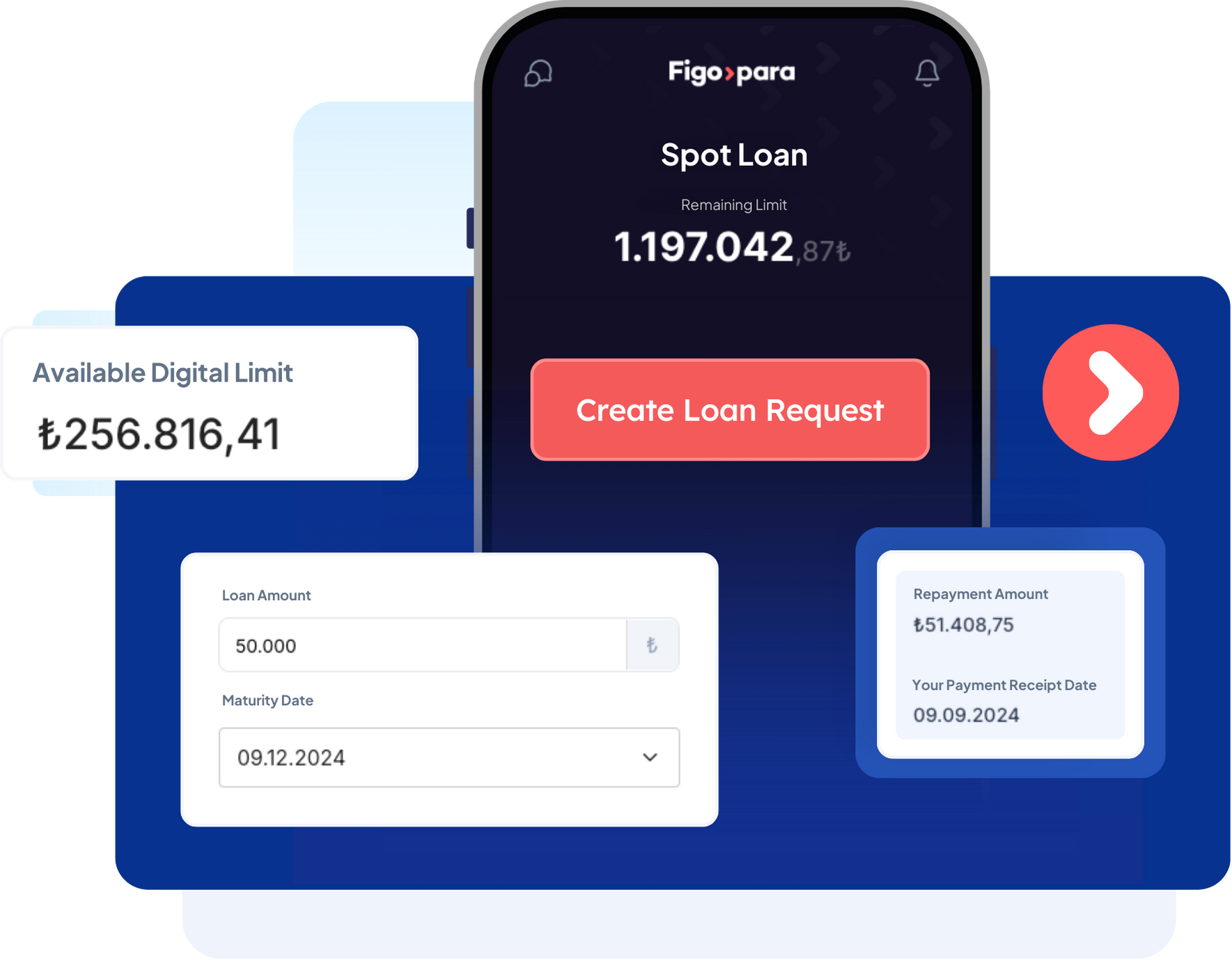

Wide Financing Network

We offer various financing solutions for your business on a single platform, such as Invoice Financing, Supplier Financing, Check Financing, and Spot Loan.

Wide Financing Network

Thanks to our user-friendly platform, you can complete your application process online, quickly, and securely.

Customer-Focused Approach

We contribute to your business's sustainable growth by offering affordable, suitable solutions for your needs.

Quick Solution for Your Urgent Cash Needs

Meet your instant financing needs immediately with our fast and easy Spot Loan without invoice collateral.

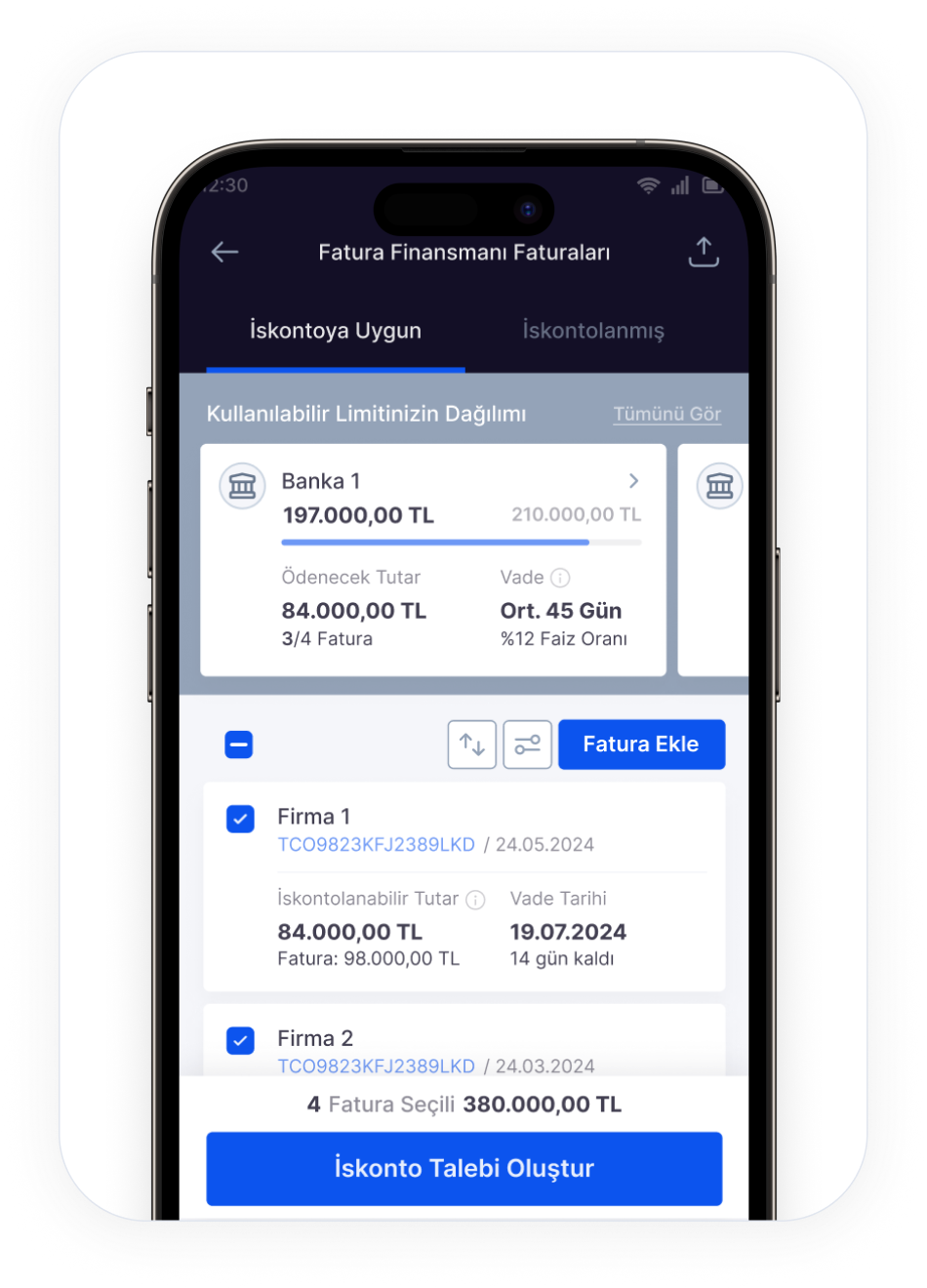

How Can I Apply for a Spot Loan?

Sign Up Now

Easily sign up to Figopara in a few minutes.

Create a Request

Create your loan usage request instantly by filling in the loan amount and maturity date you want to receive according to the loan limit the financier has defined for you.

Accept the Offer

Accept the offer from the financier, view your loan usage information, and approve the loan usage commitment.

Access Cash Instantly

Congratulations on completing your spot loan usage application. Your credit amount will be deposited into your account when your application is approved.

What Are the Differences Between Spot Loan and Invoice Financing?

It is for short-term cash needs.

It does not require invoice collateral.

The loan is repaid with principal and interest at the end of the term.

It offers flexibility for general financing needs.

It does not require sending a Receivables Notification Form.

It is for obtaining cash without waiting for the invoice due date.

Invoice collateral is needed.

Payment is made according to the invoice due date.

It regulates cash flow by accelerating the payment of invoices.

It is mandatory to send a Receivables Notification Form.