Invoice Financing

Don’t Wait for

Invoice Due Date

Businesses convert their unpaid e-invoices into cash for their cash needs.

We help businesses access financing as quickly as possible by converting their deferred invoices into cash, independent of the buyer.

35,000+

Businesses

450,000+

Invoices

10 Billion+ TL

Transaction Volume

35,000+

Businesses

450,000+

Invoices

10 Billion+ TL

Transaction Volume

What is Figopara Invoice Financing?

It is a financing model that allows businesses to collect the payment of their invoices due from their customers through banks at any time they want.

Customer-specific Scoring

We solve the trust problem between businesses and banks by determining their trade risk through machine learning.

Affordable Financing

We mediate them to access financing without collateral and at affordable costs.

Why Figopara?

Join 10,000s of businesses that accelerate their company's cash flow with Figopara!

Single platform

Online, fast and easy transactions

24+ banks and financial institutions

Quick access to cash

Favorable discount rates

Financing without collateral and cost comparison

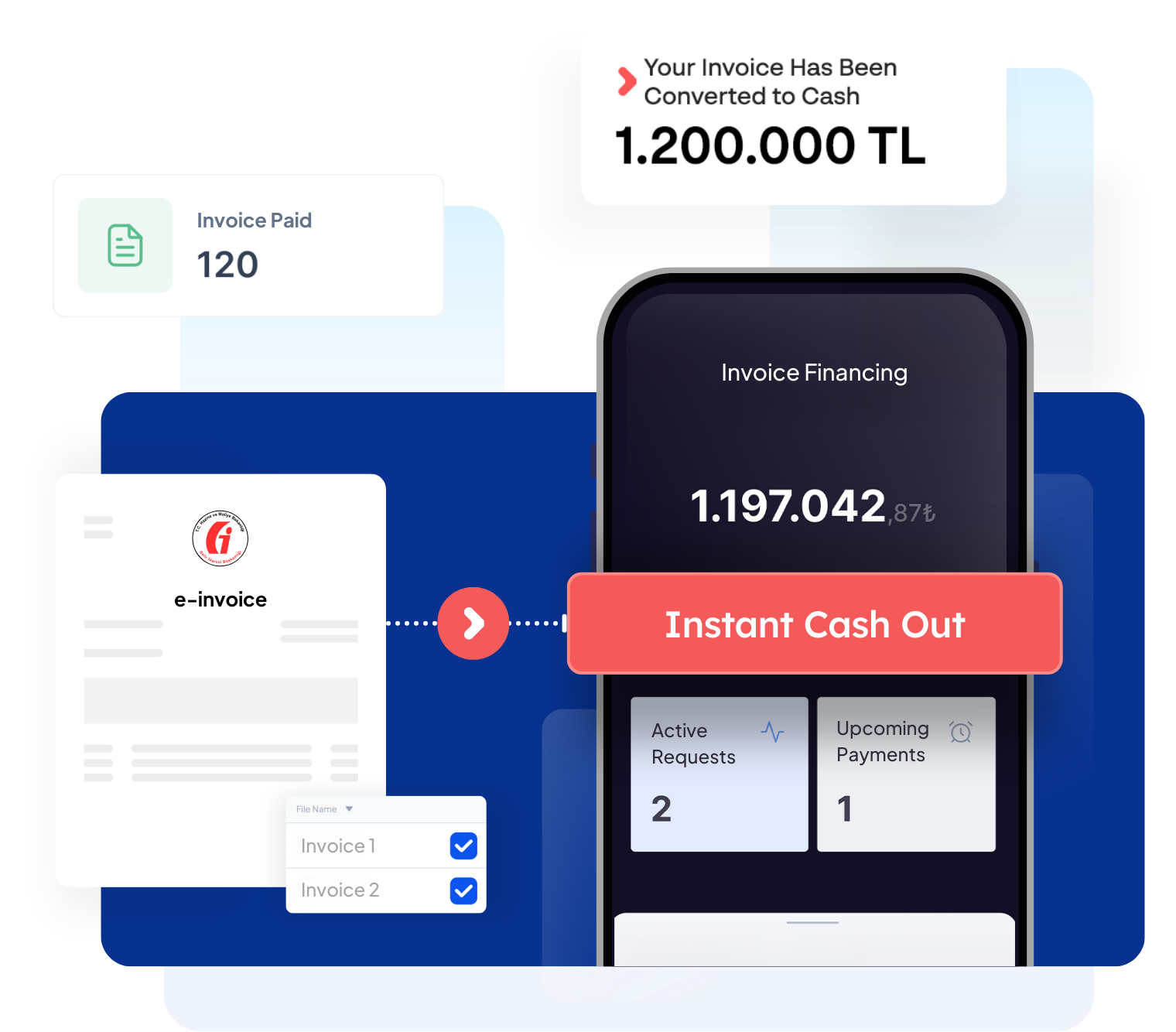

Easily Convert Your e-invoices to Cash

Apply Now

Quickly sign up in a few minutes.

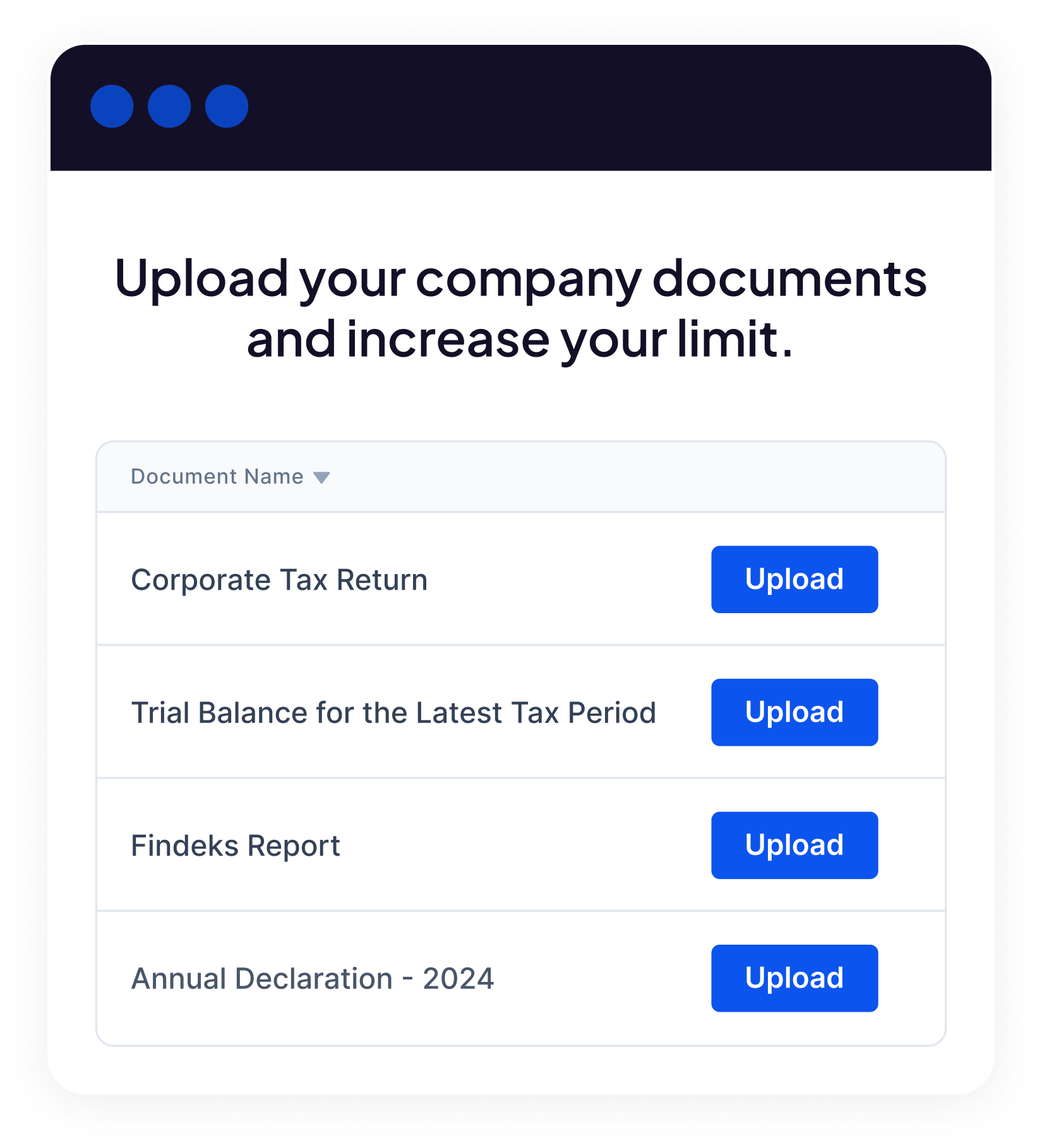

Upload Company Documents

Upload company documents and connect with the e-invoice integrator to get the credit limit.

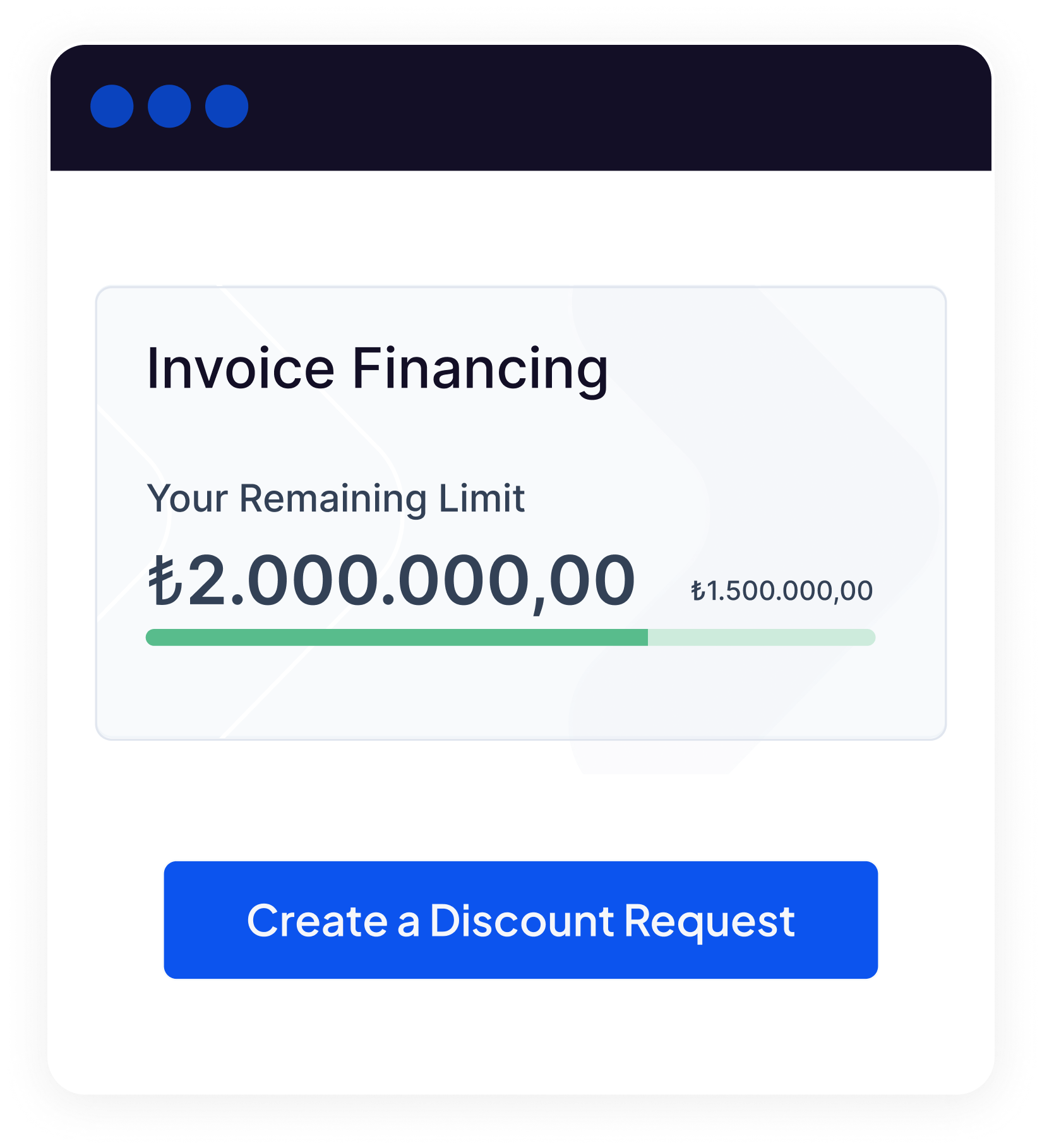

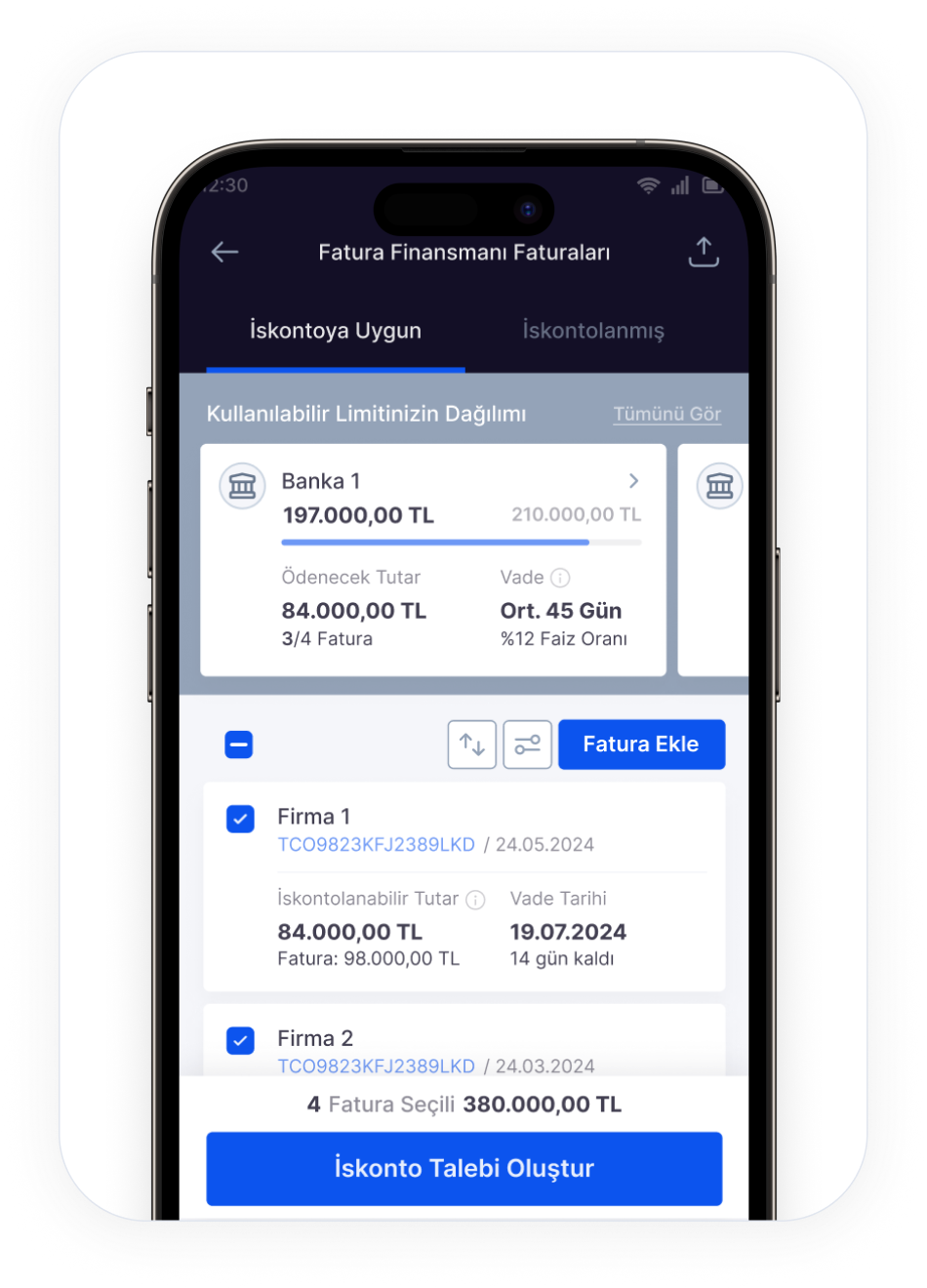

Use Credit Limit

Create a discount request by selecting the e-invoices you want to convert to cash.

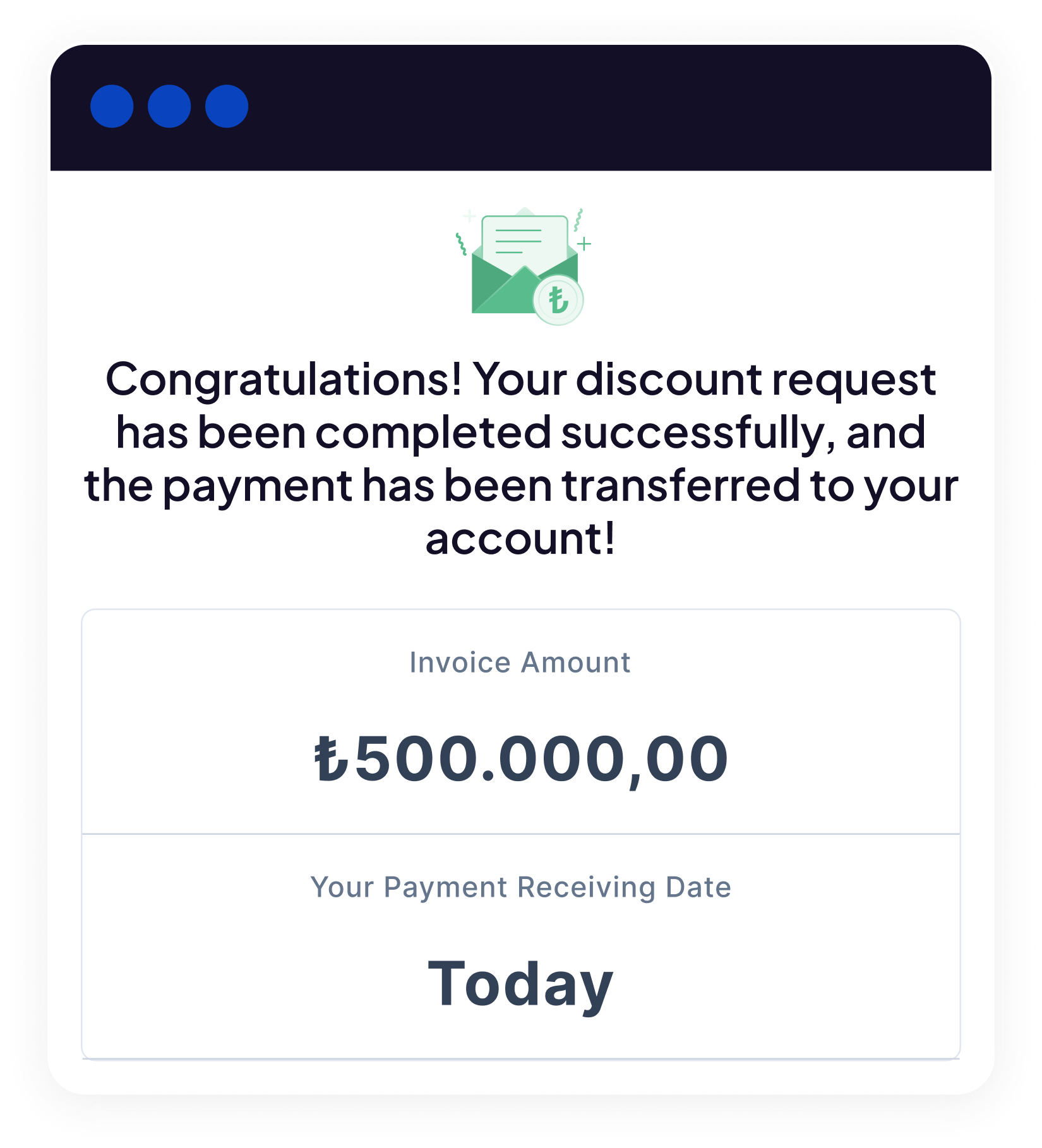

Convert e-Invoices to Cash

Convert your e-invoices to cash before their due date at affordable costs.

Our Financial Partners

You can view the discount offers of our financial partners integrated into the Figopara Invoice Financing system from a single screen and access cash whenever you want by choosing the one that suits you best.

Our Financial Partners

You can view the discount offers of our financial partners integrated into the Figopara Invoice Financing system from a single screen and access cash whenever you want by choosing the one that suits you best.

How Does Figopara Invoice Financing Work?

Commercial Enterprise;

Becomes a member of Figopara and sends the documents related to the company.

Figopara;

Checks the documents and directs them to the bank for limit request.

Bank;

Defines the limit determined for the commercial enterprise to the Figopara system.

Commercial Enterprise;

It creates a discount request by uploading its invoice to the system and converts its invoice into cash.

Collect Your e-Invoices Without Waiting for Due Date

Calculate how much payment you can receive when you want to convert your unpaid e-invoice into cash!*

Invoice Amount (TL)

Invoice Term (Day)

With Figopara:

*The calculation varies depending on the bank, invoice amount, and maturity date you choose. Your company's financial data will also affect the calculation.

Advantages of Figopara

We believe that all obstacles to the growth of commercial enterprises should be removed. Therefore, we facilitate their access to cash with different financing solutions.

Problems

Need for cash before the due date

Cash flow problems

Need for collateral to get credit limits from banks

Financial uncertainties in the market

- Maturity mismatches between receivables and payables

Solutions

By solving the trust problem between commercial enterprises and banks, we mediate them to obtain limits faster and at more affordable prices.

We help them increase their business volume and capital by accelerating their cash flow. We provide the opportunity to compare costs by gathering the offers of different financial institutions on a single platform.

We provide time and operational advantages by facilitating all transactions with our web and mobile applications.

Exceptional Transaction Ease for Our Integrators

We work with Turkey's leading integrator companies so you can obtain higher limits from financial institutions and convert your e-invoices into cash faster.

Discover Figopara Through Their Experiences

Collect Your Check Now

Easily upload your invoiced checks and receive offers from financial institutions simultaneously to collect them before their due date.